- FREE BUDGETING SOFTWARE THAT LINKS TO YOUR BANK ACCOUNT OFFLINE

- FREE BUDGETING SOFTWARE THAT LINKS TO YOUR BANK ACCOUNT FREE

These ads are based on your specific account relationships with us. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

FREE BUDGETING SOFTWARE THAT LINKS TO YOUR BANK ACCOUNT OFFLINE

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. Although this is more of a spending site than a saving site, it can help you keep your budget under control.Īuthor Bio: Bailey Harris writes about car insurance quotes and other finance topics for strive to provide you with information about products and services you might find interesting and useful. Red Flag Deals is an online bargaining community that can help you find deals on the things you buy.

FREE BUDGETING SOFTWARE THAT LINKS TO YOUR BANK ACCOUNT FREE

This financial service group provides a range of free tools for individuals, including saving and investment calculators, retirement planning calculators, and personal budget planners and worksheets. The site also offers a free forum for people who would like to discuss their debt problems and lean on others for support. MoneyProblems provides online calculators, a free debt evaluation, articles, an anonymous Q and A blog, and other budgeting tools for Canadians. You can only budget cash you have on hand, which means your budget stays realistic and you dont make numbers up. Other site features include forums, a free newsletter, and articles on saving, spending, investing, taxes, and retirement planning. Canadian CapitalistĬanadian Capitalist offers several useful online calculators in addition to a portfolio tool that allows you to track your investments and see how well they are performing. The tool is easy to use and even includes a savings calculator designed to help you meet your savings goals. The Savings SpotĬreated by the Royal Bank of Canada, this free tool helps you determine how much you can save based on your income and expenses.

It is perfect for the security-minded individual who wants to establish a budget, create saving goals, and track their spending online without entering private bank account information. Unlike many budgeting tools, BudgetPulse does not link to your financial accounts.

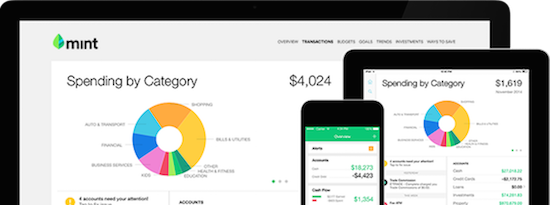

The site’s built-in community also offers plenty of support and ideas for personal and family budgeting. Wesabe helps you get answers to your finance-related questions. The site allows you to view all of your information online or print detailed finance reports. Yodlee’s free Money Center makes it easy to track your spending, pay your bills, and control your budget. The tool notifies you when you have gone over budget and congratulates you when you control your spending. PiggyPalĬredit Canada, a non-profit agency, created PiggyPal to help people monitor and improve their daily spending habits. Not every Canadian bank account can be linked to this site, but Mint is constantly adding new institutions to its list. It was originally designed for American users but has since evolved to include tools for Canadians as well.

Mint is a free money management tool that helps you see how you are spending your money. Here are 10 free sites that are worth exploring in your spare time. There are many different sites online that can help you establish a budget, track your expenditures, save for special occasions, and manage your money online. Link your bank, credit card and other financial accounts so you can see what’s happening to your financial life.

0 kommentar(er)

0 kommentar(er)